Overview

The Transaction Audit contains four groups of totals.

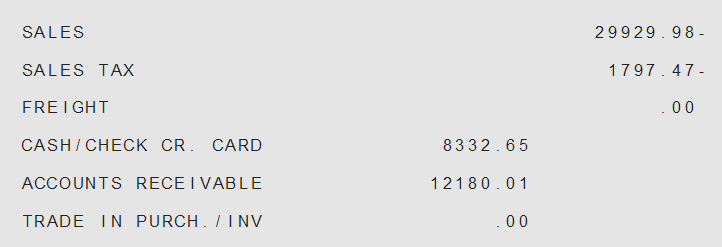

First Group

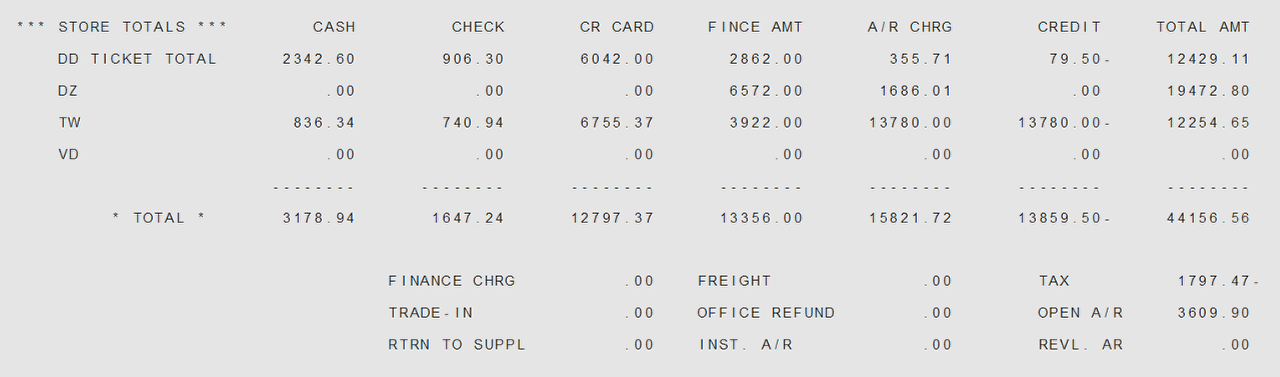

Click image to enlarge.

The first set of totals, called Store Totals, is a one line total for each transaction type, subtotaled by payment type. The last line in the Store Totals group prints the finance charge, freight, and tax totals along with the total amount of office refunds being issued for the day.

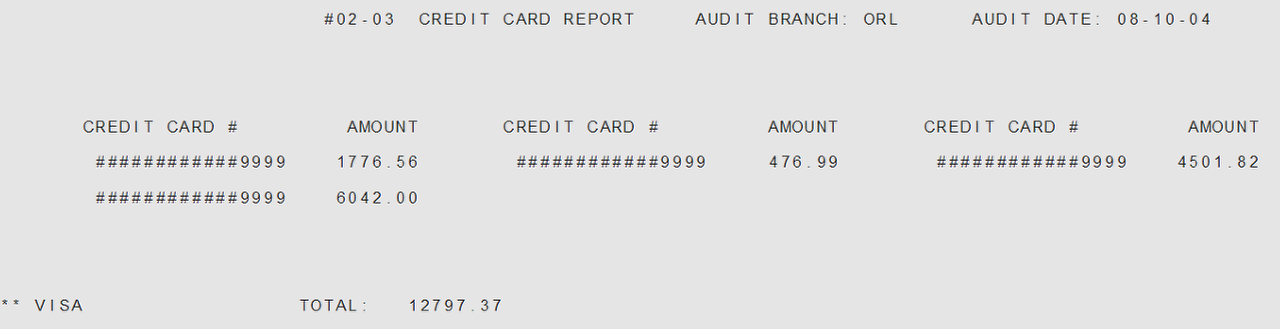

Second Group

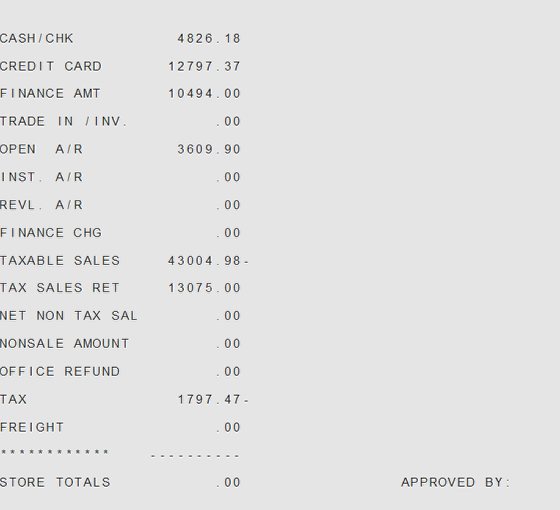

Click image to enlarge.

The second group of totals prints a different breakdown of sales totals:

Cash/Chk

This is the total of all the cash and check amounts processed through POS Entry.

Credit Card

This is the total amount of all the credit card transactions. This total should balance to the daily store reconciliation.

Finance Amt

This is the total amount of all sales that were financed by an outside finance company. This total should balance to the daily store reconciliation.

Trade In / Inv

This is the total amount of all trade ins. In the case of an RS transaction type, sales are not affected; but this field is affected.

Open A/R

This is the total of all Open Accounts Receivable activity that flows to Open Accounts Receivable. Included in this field are all ML transaction types and any credit memos that were used. (DD and SO Transaction Types charged to an Open AR account using terms of “COD” or “BAL”, are not included in this field. These “charge amounts” are not posted to Open Accounts Receivable until the items are delivered to the customer.) These are revolving or 30 day types of charges.

Inst A/R

This line includes all amounts entered that affect Installment Accounts Receivable.

Revl A/R

This line includes all amounts entered that affect Revolving Accounts Receivable.

Finance Chg

This line includes all amounts charged to a finance company.

Taxable Sales

This is the total of all taxable sales. This total is calculated using the individual detail lines from POS Entry. If ranges are set up in Department G.M./Taxable, the system recognizes the individual lines by department and their status of taxable or nontaxable. Using this information, the system calculates the tax accordingly.

Taxable Sales Ret

This is the total of all returned items.

Net Non Tax Sal

This is the total of all Non-Taxable Sales. It does not include non-taxable returns.

Nonsale Amount

This is the total of all non-sale Items. A Non-Sale Product Type begins with ‘@’ and ends with a ‘%’ and will not update into Sales Analysis or to the Inventory Sales account. These Product Types are normally used to account for fees collected. For example: license fees (@L%), tag fees (@T%), doc fees (@D%), etc.

Office Refund

This line is the total of all office refunds issued as a result of a negative TW sale (TW merchandise return), a Canceled Order (CO) or a Shipped Delayed Delivery (DZ) with a return of merchandise.

Tax

This is the total sales tax calculated and accepted during POS Entry, Quick Ship (02-08-03), or Order Check-In (02-08-15).

Freight

This is the total amount of the freight charges entered during POS Entry, Quick Ship or Order Check-In.

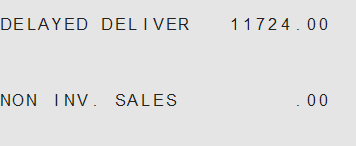

Click image to enlarge.

Included in this second group are the totals for all ‘DD’ and ‘SO’ transactions entered, plus the total of all Non-Inventory Sales:

Delayed Deliver

The value in this field is the total of all Delayed Delivery (DD) and Special Order (SO) transactions for the branch/day that are not considered completed sales.

Non-Inventory Sales

The value in this field is the total of all non-inventory dales for the branch/day. Non-Inventory product types are identified by the third character of the product type being a ‘%’ (percent) sign

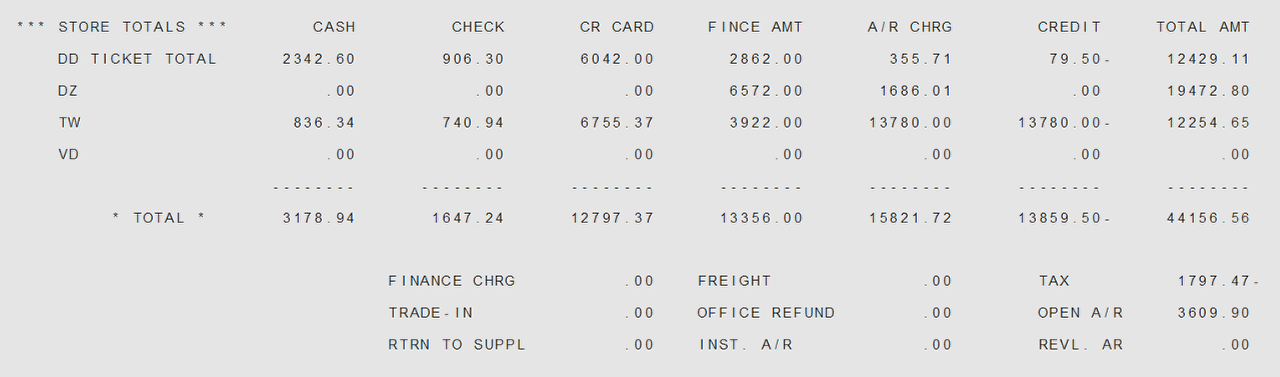

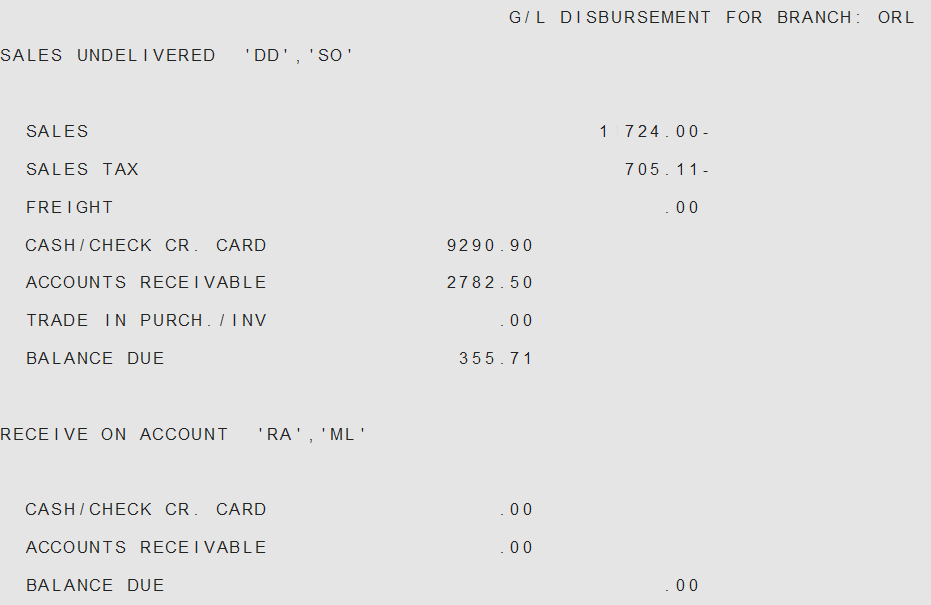

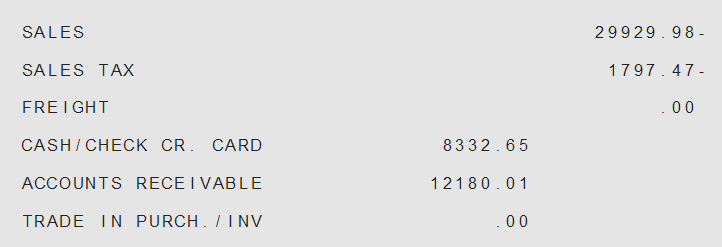

Third Group

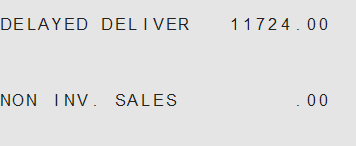

Click image to enlarge.

The third group of totals is G/L Disbursement For Branch. This group is a breakdown by type of sale, with a detailed breakdown of how the sales dollars were computed. The totals are broken down by:

Receive on Account

RA, ML

Sales Delivered

LL, DZ, SZ, TW (+/-), RS (+/-)

Financial Breakdown

Click image to enlarge.

Within each group is the financial breakdown of how the transaction was or is paid:

Sales Written

This field contains the total number of sales written that are not considered completed sales. The only transaction types involved are: DD, SO and CO.

Anticipated Sales Tax

The amount of anticipated sales tax for Delayed Deliveries (DD), Special Orders (SO), and Cancelled Orders (CO).

Anticipated Freight

The amount of anticipated freight for Delayed Deliveries (DD), Special Orders (SO), and Cancelled Orders (CO).

Cash/Check Cr. Card

The total amount of cash, checks and/or credit card dollars collected for transactions within a category.

Accounts Receivable

The value in this field includes a credit for all deposits/payments made on written sales and a debit for all sales charged to an Accounts Receivable Account.

Trade in Purch/Inv

The total dollars entered in the ‘Trade-In’ field.

Balance Due

The amount due from Delayed Delivery and Special Orders. The balance due is the Selling Price, plus Tax and Freight, less the down payment amount.

Sales Tax

The net amount of sales tax collected on all completed sales and returns, including shipped orders.

Office Refund

The total amount of Office Refunds issued.

Sales Shipped

The total amount of Delayed Delivery and Special Orders that were confirmed and shipped in the day’s processing plus all TW transactions.

Summary Total

This is a summary total of all the above.

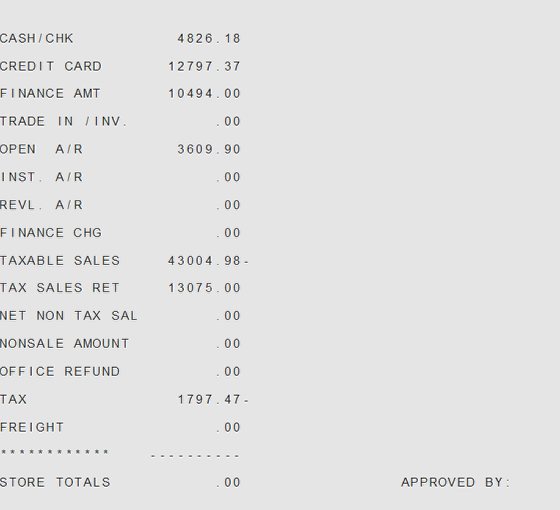

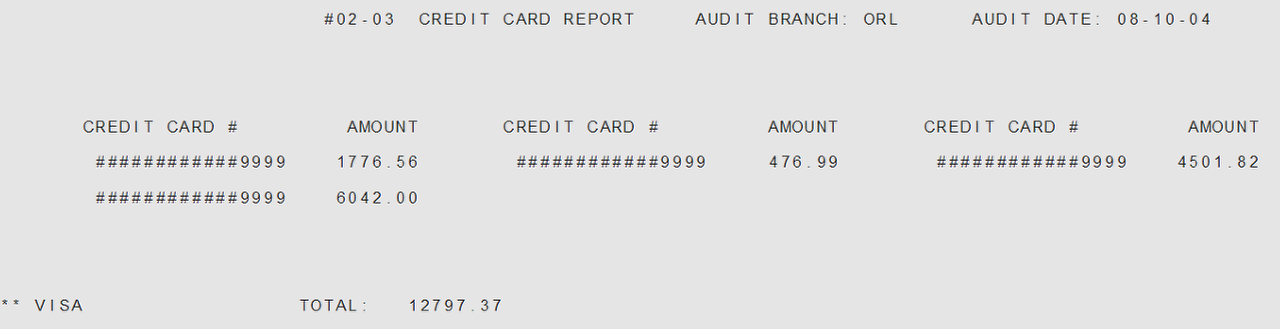

Fourth Group

Click image to enlarge.

The last grouping of totals is Summary Total. This is the summary recap of all the above totals. In addition, a Credit Card Report and a Check Reconciliation list is printed if there are credit card or check amounts entered for the branch/day.

Credit Card Report

This report prints the last four digits of the credit card number and the amount that was tendered in POS Entry. Each credit card category will print the individual transaction card numbers and amounts in three columns across. At the end of each category, a total amount will be printed for the credit card category that has been previously set up in Credit Card Maintenance (02-18-10). If the credit card category is not set up, an ‘Other’ category will print and will include all credit card numbers and amounts not included in any other category. This report only prints if there is a credit card amount on a transaction for the branch/day.

Check Reconciliation

This report prints the check number and the amount tendered on individual transactions (in 3 columns across), followed by a check total of all checks printed on the reconciliation. This report only prints if there is a check amount on a transaction for the branch/day.