How To: Reconciling G/L with Your Bank Account Monthly (15-50)

Overview

This tutorial describes how to reconcile GL with your bank statement on a monthly basis.

IMPORTANT: Before completing the process described below, make sure that you have completed the Bank Reconciliation: Setup for First Time Use procedure.

Step-by-Step

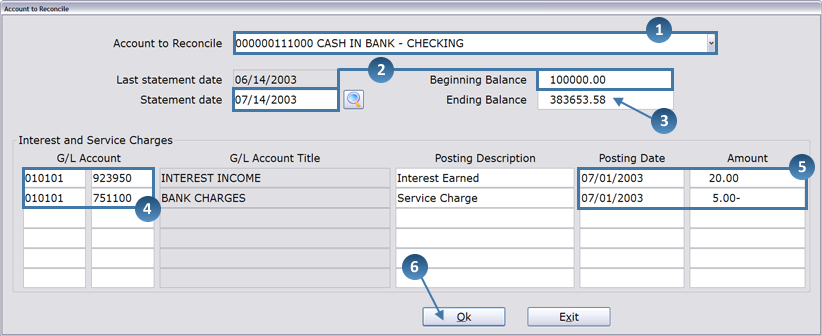

- In the Account to Reconcile field, enter the full 12-digit account number being reconciled.

- Once you complete the reconciliation for an account, the account number will be available from the drop-down list.

- The beginning balance automatically appears, along with the statement date.

- Enter the ending balance amount from your bank statement.

- Remember that the decimal point and trailing zeros must be entered for the balance amounts. For example, if the ending balance is $225,000, you would enter “225000.00” in the field.

- Now, take a look at the Interest and Service charges block. This section is used to enter any charges or amounts earned that the bank credits and debits automatically (i.e. service charges and interest earned). In the GL Account field(s), enter the appropriate GL account numbers for charges and amounts earned.

- Next, enter the posting dates (mm/dd/yyyy) and the amounts for each account. Charges should be entered as a negative amount, and amounts earned (i.e. interest) should be entered as a positive amount.

- When all accounts have been entered in the Interest and Service charges block, click OK.

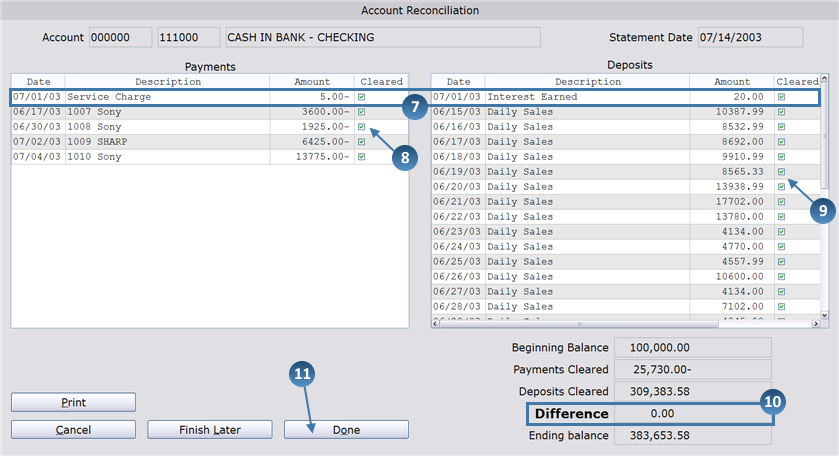

- The reconciliation screen now appears with payments appearing on the left and deposits appearing on the right. Notice that the Interest and Service Charges appear in the appropriate blocks and that the Cleared box is checked for each.

- In the Payments block, check all payments that have cleared the bank.

- In the Deposits block, check all deposits that have cleared the bank.

- In the bottom right corner of the screen you will see the difference between the Payments Cleared and Deposits Cleared:

- If the difference is zero or is the same amount as the outstanding checks, click Done.

- You could also click Finish Later, which allows you to come back to this selection and finish the reconciliation at another time.

- If the difference is not zero, the Adjustments box now appears.

- If you need to make an adjustment, enter the GL account number for the adjustment and click Yes.

- If you don’t need to make an adjustment, click No.

IMPORTANT: For the first couple of reconciliations, you should answer No to this prompt.

- Decide whether you want to print a Reconciliation Report and/or an Unreconciled Entries report.