FAQs: 21.100 General

Overview

This article answers some of the most frequently asked questions about Tyler’s 21.100 Release.

Table of Contents

FAQs

Accounts Payable

- It’s the first week of the month and I’m running Aging Detail (11-20). Why am I seeing more information than what I expect for the end of the month detail?

- Your accounts payable aging looks at the date that was entered when you signed into the AP selection; it runs aging up to that date. Change that date to alter what aging displays.

- How do I process a payment received from a vendor paying my account for a credit memo received earlier?

- First print out (11-31), Transaction File Inquiry, so that you will have the correct invoice number for the credit memo. Next, go into (11-01), Invoice Entry, and enter the vendor code. In the Invoice field, enter the original credit memo number; enter DM as the transaction code; and, in the Total field, enter the amount of the check. Input the date you received the check as both the invoice date and the due date. The vendor’s check number goes in the Credit Number field, and the GL number for the bank account where you want to deposit the check is entered in the PO number field. Run Audit/Update (11-03). Now, back in (11-31), the credit memo and debit memo will cancel one another out. Once (15-10) has been updated, a General Ledger Inquiry (15-07) will show the money in the designated bank account.

- During a check run, the printer jammed and 4 checks did not print. When I try to reprint them, the next check number that the system is trying to use is bad. How do I correct the check number that Tyler is using?

- When reprinting the checks, the system will confirm the next check number. Change that field to the appropriate number.

Accounts Receivable Open

- I am trying to close my month for Open AR (12-80) but I keep getting a message that “AR open maintenance needs to be printed.” What does that mean?

- This means that you have made changes to one or more accounts through selection (12-21), but did not print a hard copy of these changes. Go into (12-21), tab through the account number field and say Y to printing a hard copy.

- What will purge when I run Open Account Purge Process (12-42)?

- Temporary accounts are purged as well as the detail lines within permanent accounts meeting certain criteria. The purge criteria are as follows:

- At least one credit

- At least one debit

- Matching invoice numbers or matching cross reference numbers

- All invoices within the grouping net to zero

- I have an AR account that has a net balance of zero but none of the invoice numbers match. As a result, nothing is purging. How can I get the detail lines to purge?

- You can match the cross reference numbers through “Transaction Maintenance” in (12-21). After entering the account and invoice information, change the cross reference field to a six digit number of your choosing. Continue with all invoices in this grouping, using the same cross reference number for each invoice.

- I’m trying to age my account for month end processing (12-40) but I keep getting a message that says: “Previously selected cycle not run to completion” what does this mean?

- It means that the last time the AR Aging was run, it was indicated that statements would be printed, but that process was never completed. In order to age for a new date, the process must be completed by printing the statements. If the statements are not really needed, you can always print the batch to the spooler or to PDFs.

- How do I set-up accrued co-op or accrued rebate accounts in receivables?

- Please refer to page 2 of the AR Open Documentation for this information.

Customer History

- When is customer history updated?

- Customer History is updated when each sales day is closed (02-05).

- Why would an item sold not appear in Customer History?

- There are a few things to consider if this occurs:

- At the time of the sale, the item must have been flagged in the Inventory Master for Customer History to have recorded it.

- Customer history writes to the Ship To customer.

- The item will not appear in Customer History until the line is shipped.

- If the item has been shipped, the line will not display until the sales day has been closed.

- Has a Discretionary Purge been run?

General Ledger

- How long can I keep my GL open?

- A maximum of 12 months.

- What does the message “location summary record not found XXXXXX” mean?

- This means that at least one P&L (profit and loss) account is missing its Income Summary account–the last account on a P&L. To find the missing account, print the Chart of Accounts (15-20). Tab through to select all possible P&L accounts. Often this error is caused by a user accidently creating a new account, using a 6 digit prefix not within a current P&L range. If this is the case, decide if the account should be merged into another account, or, add the matching income summary account.

- What does the message “Balance sheet CYTD will not match your income statement CYTD,” mean?

- Typically this is not an indication that the balance sheet is truly out of balance. Rather, it means that an offsetting entry was not done for a prior period journal entry. This indicates a prior period journal entry, within the current fiscal year, made after the last GL closing. Use the RDB titled “$GLPTRN” to find the entries involved. Double check that the current RDB matches the following command list:

INPUT GL.PTRN

PRINTER ?

TITLE “$GLPTRN…LIST PRIOR TRANSACTIONS FOR BALANCING”

TITLE “RUN THIS REPORT WHEN RECEIVING A MESSAGE IN 15-40 THAT SAYS”

TITLE “YTD CURRENT P/L WON’T MATCH YTD INCOME STMT.”

TITLE “THIS REPORT WILL ASSIST IN FINDING THE OFFSETTING ENTRIES”

TITLE “NEEDED FOR CLOSING GL”

SELECTING IF JOURNAL.SOURCE NE ‘M/E’ AND

CUT.OFF.YEAR EQ ’09’

SORT ON ORIG.DATE.ENTRY;FIRST.HALF.GLNO

REPORT

PRINT CUT.OFF.DATE;GL.FULL.NO;JOURNAL.SOURCE;DESCRIPTION;

REFERENCE.NO;ORIG.DATE.ENTRY;TRANSACT.AMOUNT

TOTAL TRANSACT.AMOUNT

BREAK ON FIRST.HALF.GLNO

- How does the system know what GL account number to use for merchandise inventory to offset entries?

- Automatically offsetting GL numbers is set up in Tyler through (15-14) and printed through (15-15). This is where offsets such as AR Control, AP Control, Clearing Accounts and Merchandise Inventory are maintained.

- Are there any additional entries when making a prior period journal entry?

- It depends on the details of the journal entry. To determine the proper steps that should be taken when doing a journal entry, please see the section on journal entries in the General Ledger documentation.

Inventory

- I am ready to update my Physical Inventory, but I can’t get my status to an E, no matter how many times I print the Posting Audit (03-30-06).

- When printing the final Audit, make sure you leave the Book, Section and Team fields blank. If you enter something in any of these three fields, the computer thinks it is only a partial audit.

- Does Product Type Consolidation (05-91-02) change the Transaction Detail History file, and if so, how far back?

- Yes, it does. During the update, the user will be asked how far back to change the transaction detail.

- How can I find the current status of an inventory transfer?

- Document Number Journal (03-11-23) will show the transfer Document number, the transfer date, the outbound branch, the inbound branch, the originating clerk, the transfer status (the last step completed), and the awaiting process (the next step required).

- At what point does an item being transferred reduce the quantity on hand of the From Branch and then increase the quantity on hand of the To Branch?

- This largely depends on how the preference “Activate Request for Transfers?” is answered in your Inventory/Transfer preferences (03-11-90-01). If it is answered N, then after making the transfer in Transfer Entry/Maintenance (03-11-01) the on hand is reduced at the originating branch and increased at the receiving branch.

If this preference is set to Y, the on hand number is reduced at the originating branch after the Picking Sheets are generated (the item will be listed as Relocate Outbound in the Inventory Available for Sale selection (03-07) at this point). After Shipping Confirmation is completed at the receiving branch, selection (03-07) changes to Relocate Inbound for the receiving branch. The on hand number for the receiving branch is increased after running Receiving Confirmation (03-11-13).

- At what point during a Physical Inventory can I begin processing and updating sales transactions?

- All sales entries can be processed as normal as soon as the Posting File Load (03-30-04) is completed.

- In Master File Inquiry Maintenance (03-01), what does the entry in field 7, Floor Plan Flag, indicate and where does the value come from?v

- An “S” entry indicates a special order item created through ticket entry using the SO ticket type (Automatic Special Orders is a licensed option). The entry “T” designates a trade-in item, created during ticket entry, using the TI in-quantity field to indicate an item brought in as a trade in. A “+” in this field indicates an item not eligible for extended warranty. This setting is applied by the user to an item in Master File Inquiry Maintenance (03-01).

Payroll

- Can I process a payroll in the New Year prior to running W2 forms?

- No, you must run your W2 forms and the YTD reset in payroll first.

- Can W2s be run more than once?

- Yes, they can be run as many times as needed, as long as the YTD Reset (10-15) has not been run already.

- Will my company information print on the W2 forms?

- Yes. Your company info comes from System File Management (30-01); the Federal ID# is pulled from FICA & FUTA (10-33), while the State ID is supplied by the State SDI & SUTA (10-30) selection.

- I just ran my Payroll Automatic Selection (10-01). I entered 80 as the Regular Hours, however my payroll preview check file is showing .80 hours, why is this?

- This selection requires you use a decimal point with the hours, for example, enter “80.00” for 80 hours. To make necessary corrections, enter payroll’s Work File Hourly/Salary Maintenance selection (10-07) and type Delete at the prompt. Then return to selection (10-01) and re-enter the information, being sure to use the decimal point when entering in the hours.

- I have an employee that has neither federal nor state withholding tax being deducted from their paycheck, why?

- Check Employee Special Maintenance (10-21). Fields 11 and 14 must be answered yes with the percent of withholdings entered. If the % Withheld field is left blank, the system assumes a zero percentage and withholds nothing.

- I have set up selection (10-26), 401(k) Contributions for each of the employees participating, but have run the Preview Check Register, selection (10-11) and no 401(k) deductions are showing.

- Check FICA & FUTA (10-33) to see if the field Maximum 401(k) Contributions has been left blank.

- When should I run my employee termination list?

- It is very important that you wait until the first of the year and only after you have run your W2s.

- Why would a bonus check have such a high withholding percentage?

- Bonus check (earnings code BNE) will bypass the withholding tables and deduct a flat percentage.

- What is the correct way to reverse an updated paycheck?

- The only way to reverse an updated paycheck is to issue a manual check (10-16) with negative amounts.

Purchase Orders

- I have purchase orders in Received, Not Invoiced (04-44) that have already been entered through AP Invoice Entry (11-02). How can I remove them?

- Enter the purchase order in PO–AP Entry (04-20) and type the word Delete in the Invoice Number field.

- I have invoices in AP that will not purge when I run Month End Transaction File Purge (11-45). If the total for these transactions balances to zero, what could be the cause?

- Make sure the digits of the invoice match exactly. If the DI has a status of H, make sure the corresponding credit is also at an H status. Also, verify that there is only one DI for that particular invoice number.

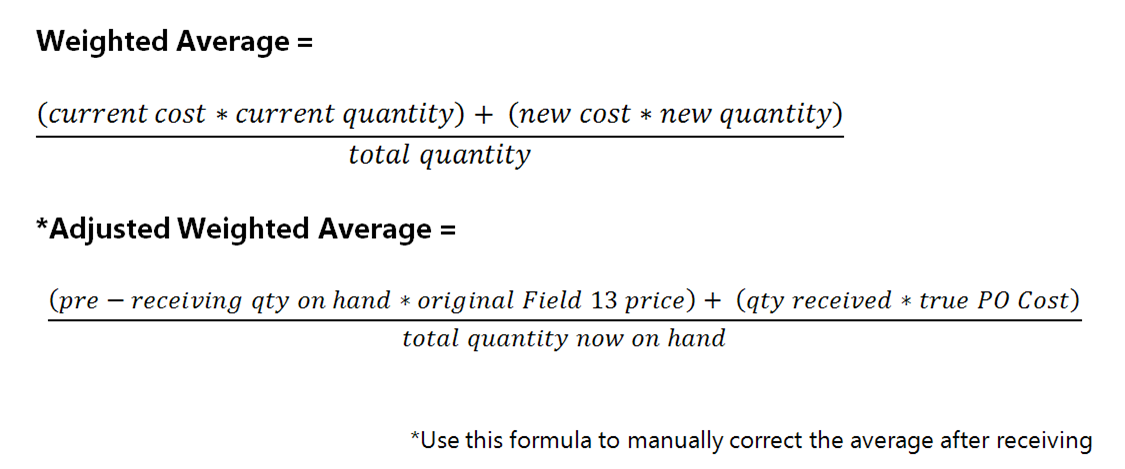

- What should be done if an invoice comes in with a cost that is different from the received cost?

- If the PO is correct, voucher the correct amount into PO–AP Entry (04-20) during invoice entry. If the invoice is correct, consider that the weighted average for those items will be incorrect and manually maintain, if desired.

- Can I use the Tyler PO system for items not in the Inventory Master?

- Absolutely. Ordering office supplies, etc. is fine. The PO system does not validate item numbers, though it will warn you when an entered item is not in the Inventory Master File. However, if you wish to track this inventory through the system, it must be entered in the Inventory Master File (03-01) first.

Sales Analysis

- If sales are updating daily will running Reset Monthly Sales History (05-80) still hit the COG (cost of goods) GL account at month end?

- No. The COG account is updated daily, along with sales in this case. Please review the Ticket GL Interface Preferences selection (02-18-13) to decide if NIPT (non-inventory product types) will update to GL. This flag replaces the question that is asked in (05-80) at month end. You must still run (05-80) at month end to zero MTD (month to date) sales dollars.

- Why are there dollar amounts showing in the Monthly Sales report (05-20) for the ‘000’ error account?

- The ‘000’ number represents transactions run by an employee(s) set not to record sales analysis detail. Check Employee Master Maintenance (10-20) for the employee(s) that made these sales and change their field 24 (Sales Analysis Kept?) to Y. The data will be recorded under their employee number in the future.

- What does Selection (05-16), ‘D’-Delivered Sales and ‘W’-Written Sales do?

- The prompt in Selection (05-16) determines if reports will be based on delivered or written sales. This field should be verified before running any reports. Note that some reporting will specifically ask during the selection which sales type is to be printed and this selection will over ride the selection in field 16.

Sales Transactions

- How are items made non-taxable without making the entire ticket non-taxable?

- Departments or product types can be set-up as non-taxable in (02-18-02), by changing the taxable flag to N.

- How are terminals designated as POS?

- In System File Management (30-01), page 2, enter “A” at the prompt for add/change, input the terminal you want to make POS and indicate Y in the POS column.

- During ticket entry is there a way to see the gross margin information for each line?

- Yes, after accepting each item the gross margin information for the line and ticket is displayed in the far right of the tender block. The line margin is the top number while the total margin is the number beneath it.

- When trying to run a sales audit for the day what does the message, “Orders exist with a shipping date on or before this date” mean?

- This message means that there is an order processing order that has begun (but not completed) the shipping process for a date on or before the day you are trying to audit. This order(s) will either need to complete the shipping process or be unconfirmed. The quickest way to find this order is to use Order Status inquiry (02-08-04). Look for orders at a status 2 or higher.

- In Order Processing Status (02-08-04) what does the message “Required Restart” mean?

- This means that there was an interruption while maintaining or shipping this order. This often can be attributed to power outages, terminals timing out after being left unattended, or partitions being closed incorrectly. An order can be restarted by pulling the ticket up in Order Maintenance (02-08-02). A link to Order Maintenance can be found on the Order Processing Status screen.

Service

- At what point does a part listed on a work order get deducted from the system’s quantity on hand?

- The on hand number is reduced when that item’s part line (on the work order) is changed to a status of I (installed). If that part is later removed from the work order, it will be added back to the quantity on hand.

- Is it possible for service parts set up in Parts Entry/Maintenance (07-45-01) to write to a separate COG (cost of goods) account than the COG used by items set up in Master File Inquiry Maintenance (03-01)?

- Yes, provided that the master inventory file (03-01) and the service parts file (07-45-01) don’t have any departments in common. In this case, service parts will be written to the GL number assigned to the transaction code “COP” in Transaction Code Maintenance (03-13). Please note that the offsetting entry for both merchandise COGS and parts COGS remains the GL number assigned to the source code of I/P in (15-14). This is the GL number typically used for merchandise inventory.

- Is it possible to close a work order with a COD balance?

- Yes. Down payments and CODs on work orders will write to a temporary AR account once the sales day is closed. AR accounts produced automatically by the system will have the following account structure “WK-XXXXXX” (where XXXXXX is the Work order number).

Start of Day

- When should Start of Day be run?

- It can be run at night or first thing the next morning, as long it is before the first ticket of the new day is entered.

- I get a message saying ‘Warning: Future Price Changes Are Pending, Continue (Y/N),’ when I enter the transaction entry date in Start of Day. What does that mean?

- This message appears if there are price changes on file that go into effect on or before the specified transaction entry date and those changes have not been updated to the Inventory Master File. The changes described are set up in Future Price Change (03-32).