How To: Reconciling A/R Open with G/L (Month End)

Overview

The following describes how to reconcile Accounts Receivable Open to the General Ledger at month end. This process is completed by comparing A/R Aging Report to the A/R Control Account in the General Ledger and analyzing/correcting any discrepancies that exist.

Video

Tip: Use the controls on the video player to watch in Full Screen mode, adjust the quality, or watch on YouTube.

Step-by-Step

- Find the month end balance for the A/R Control Account (G/L side) by running one of the following selections:

- General Ledger Inquiry (15-07)

- Preliminary Balance Sheet (15-23)

- Working Trial Balance Sheet (15-21)

- Transaction Journal (15-22)

- Obtain the month end balance for the A/R Subsidiary Ledger by printing the A/R Aging Report (Aged Analysis by Selection, 12-34), which lists all accounts that have the last day of the month as the cut-off day.

- Aging Category –All (1)

- Type of Balance – All (1)

- Sorting – Any

- Type of Account – All (1)

- Range – All (1)

For reconciling the Subsidiary Ledger to G/L, your print selections should be:

- If the total from the A/R Aging Report matches the total in the A/R Control Account, reconciliation for Accounts Receivable Open is complete.

If the totals do not match, please complete the following:

- Confirm that A/R was successfully reconciled for the previous month. If it was not, the reconciliation process needs to start in the month where the discrepancy first occurred.

- Confirm that no A/R detail has been purged for the month that you are attempting to reconcile.

- Ensure that all General Ledger updates have been processed:

- Journal Entry Update (15-06)

- Interface Update (15-10)

- Future File Update (15-10 or 15-06)

- If your General Ledger is behind (not in the same month as Sales Transactions, Sales Analysis, etc.) verify that you are using the A/R Control balance which, includes the future file entries up through the month being reconciled. G/L Inquiry (15-07) automatically includes updated future file entries in the account balance, so this is a good place to obtain the accurate balance.

- Transaction codes that are expected in the A/R Control Account are ‘T/P’ (Ticket Processing) or ‘A/R’ (Cash Receipts and A/R Adjustments). In G/L Inquiry (15-07), look for transaction codes other than ‘T/P’ or ‘A/R’. If you find any, this is most likely the cause for problems with reconciliation. These entries would have affected the G/L side and not the A/R detail.

- Ensure that the A/R Aging Report Cut-Off Date is the last day of the month.

- Confirm that the A/R Aging file build was completed before printing the report. To do this, re-select the A/R Aging Report options (12-34-02). Then wait 5-10 minutes, reprint the report and compare it to the General Ledger.

- If you are still unable to reconcile the accounts after completing the above steps, you need to isolate the problem through RDB reports.

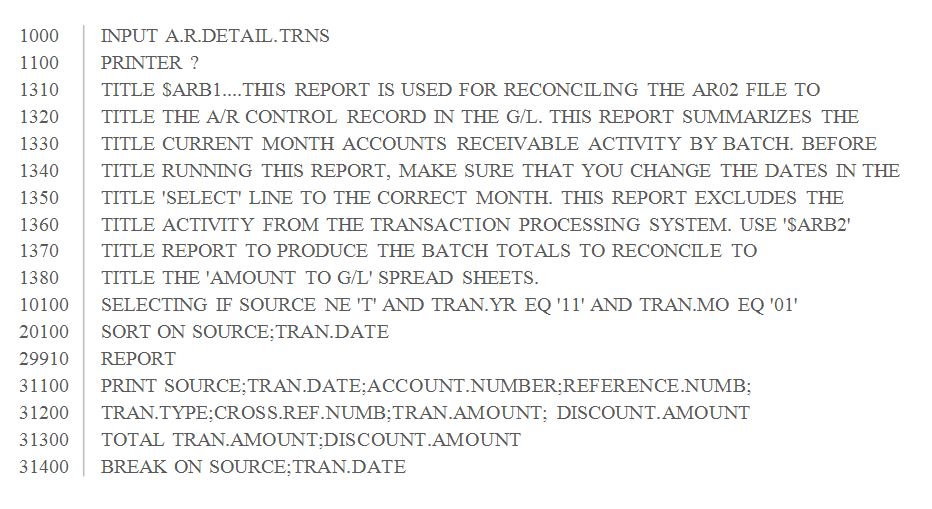

- Access the RDB Maint/Run a Report selection (32-01) and open the command list for the ‘$ARB1’ report.

- Verify that your ‘$ARB1’ report is the same as the one shown here. This report looks at transactions coming from A/R Cash Receipts and A/R Adjustments.

- Change the date on the ‘SELECTING’ line to be the year and month being reconciled.

- Make any other necessary changes to the command list and then enter “P” to print the report to paper.

- Print the transactions for the A/R Control Account in the General Ledger. You can use either a print out from G/L Inquiry (15-07) or the Transaction Journal (15-22). If your G/L is behind, Tyler recommends using a print-out from 15-07, because entries in the future file will automatically be included.

- On the $ARB1 report, compare the “Transaction Amount” column to the G/L print-out for the A/R Control Account day by day. If the $ARB1 report shows any dollars in the ‘Discount Amount’ column you will need to reconcile those G/L number(s) as well. These discount entries come from adjustments made to cash receipts and most often occur when finance company charges are written off during cash receipt entry.

- If you are able to reconcile daily activity between the G/L and $ARB1, you can eliminate A/R Adjustments and Cash Receipts as the cause. Put the $ARB1 report aside, and move on to reconciling Sales Transactions as the possible cause.

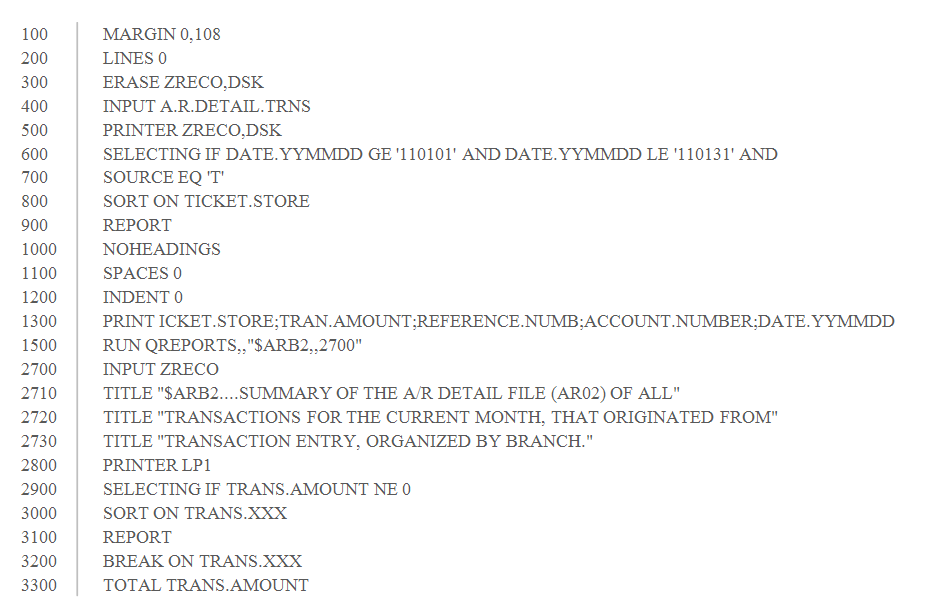

- The first step is to reconcile the total dollar amount for each branch by using the $ARB2 report and the G/L Spreadsheet (02-40).

- Again, access the RDB Maint/Run a Report selection (32-01) and this time open the command list for the ‘$ARB2’ report.

- Verify that your ‘$ARB2’ report is the same as the one shown here. This is a one page report with a single total by branch.

- Change the dates on the ‘SELECTING’ line to the dates you are reconciling.

- Enter “P” to print the report to paper.

- Retrieve the G/L Spreadsheet (02-40) that was printed as a part of month end closing. For each branch, sum the column totals for ‘Open A/R’ and ‘Finance’ and compare those totals to the branch totals on the $ARB2 report.

- If all branch totals match, it is recommended that you review this tutorial from the beginning to ensure that no steps were missed. If you are unable to locate the problem after reviewing, contact Tyler support for assistance. Please be prepared to send support all of reports that you have been working with.

If you were able to locate a branch total that does not match, the next step is to reconcile the daily totals of that branch to further narrow down the cause.

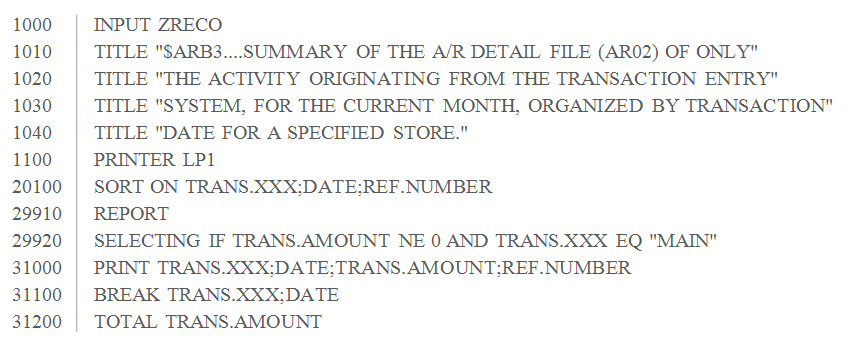

- Open the command list for the RDB Report ‘$ARB3’ and verify that your report is the same as the one shown here.

- Edit the report to only include transactions from the branch that has been identified as a problem.

- Print the report to paper.

- Using the G/L Spreadsheet (02-40) for the G/L side of the process, sum the column totals for ‘Open AR’ and ‘Finance’. Then compare the daily G/L totals to the daily A/R totals to find the day or days that do not reconcile.

- Once the branch and day of the month are identified, each individual transaction will need to be looked at. Using the batch detail in G/L inquiry (15-07), find each ticket that affected the A/R Control Account and match the dollar amount to the corresponding A/R Account in Account Activity (12-61).

- When you locate the transaction(s) that are causing the problem you may want to contact Tyler support for advice on how to resolve the issue. When contacting Tyler support, please be prepared to provide the above mentioned material and the steps already taken to resolve the issue.