How To: Reconciling A/P with G/L (Month End)

Overview

This document describes how to reconcile Accounts Payable to the General Ledger at month end. This process is completed by comparing A/P Aging Detail Report to the A/P Control Account in the General Ledger and analyzing/correcting any discrepancies that exist.

Video

Step-by-Step

- Find the month end balance for the A/P Control Account (G/L side) by running one of the following selections:

- General Ledger Inquiry (15-07)

- Preliminary Balance Sheet (15-23)

- Working Trial Balance Sheet (15-21)

- Transaction Journal (15-22)

- Obtain the month end balance for the A/P Subsidiary Ledger by printing the A/P Aging Detail Report (11-20), which lists all accounts that have the last day of the month as the cut-off day.

- If the total from the A/P Aging Detail Report matches the total in the A/P Control Account, reconciliation for Accounts Payable is complete.

If the totals do not match, please complete the following:

- Confirm that A/P was successfully reconciled for the previous month. If it was not, the reconciliation process needs to start in the month where the discrepancy first occurred.

- Make sure that the A/P Processing Date is set to the last day of the month that is being reconciled. The A/P processing date is entered when you first sign into the Accounts Payable application and is not the same as the Start of Day date. If you are unsure of what the A/P processing date is, please contact Tyler support for more information.

- Confirm that no A/P detail has been purged for the month that you are attempting to reconcile.

- Ensure that all General Ledger updates have been processed:

- Journal Entry Update (15-06)

- Interface Update (15-10)

- Future File Update (15-10 or 15-06)

- If your General Ledger is behind (not in the same month as Sales Transactions, Sales Analysis, etc.) verify that you are using the A/P Control Balance, which includes the future file entries up through the month being reconciled. G/L Inquiry (15-07) automatically includes updated future file entries in the account balance, so this is a good place to obtain the accurate balance.

- Transaction codes that are expected in the A/P Control Account are ‘A/P’ (credits and debits processed through the A/P module) and ‘P/O’ (merchandise invoices processed through P/O-A/P Entry [04-20]). ). In G/L Inquiry (15-07), look for transaction codes other than ‘A/P’ or ‘P/O.’ If you find any, this is most likely the cause for problems with reconciliation. These entries would have affected the G/L side but not the A/P detail.

- If you have made the Journal Entry for Received Not Invoiced Purchase Orders before performing the reconciliation, you must subtract those dollars from the balance in the Accounts Payable Control account in the General Ledger. Those dollars will not be included in the Accounts Payable detail since they have not been processed through P/O – A/P Entry or Invoice Entry (11-01).

- If you are still unable to reconcile the accounts after completing the above steps, you need to isolate the problem through RDB reports.

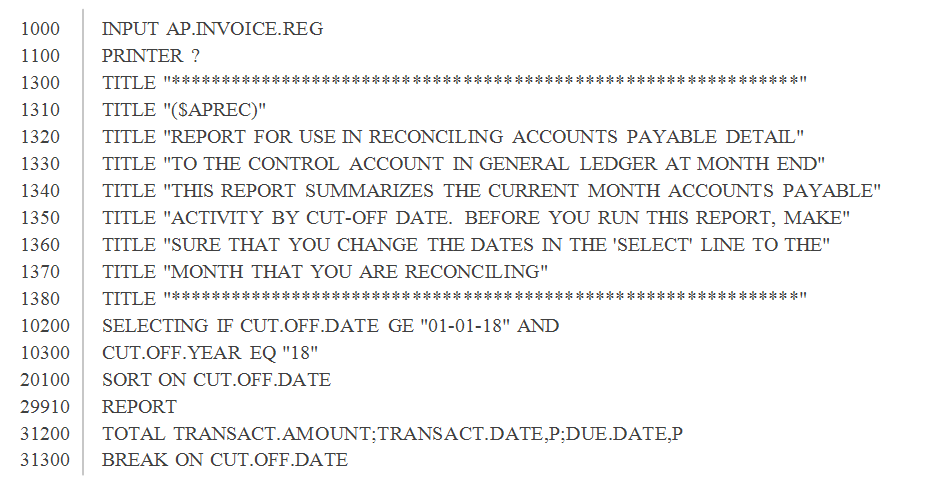

- Access the RDB Maint/Run a Report selection (32-01) and open the command list for the ‘$APREC’ report.

- Verify that your ‘$APREC’ report is the same as the one shown here. This report shows a batch total by cut-off date as well as a transaction date.

- Change the date on the ‘SELECTING’ line to the first day of the month that you are reconciling.

- Enter “P” to print the report to paper.

- Compare the ‘Transaction Date’ column to the ‘Cut-Off Date’ column. The transaction date is the date on which the transaction is included in the total of the Aging Detail Report. The cut-off date is the date on which the transaction is included in the General Ledger.

If you find a transaction where these dates (month and year) do not match, this could be the reason why your figures do not reconcile. However, it is possible that this has been done deliberately. For example, there are times when an invoice is entered in the current month, but the invoice is posted to the G/L for the next month (or the month that you anticipate cutting the check).

- If the discrepancy is caused by the transaction date and G/L cut-off date being in different months, you have reconciled A/P and no further action is required.

If the discrepancy is not caused by the transaction date and cut-off date being in different months, you need to compare the cut-off dates and amounts on the ‘$APREC’ report to the dates and batch totals in G/L. To do this, print the A/P Control Account using the G/L Inquiry screen (15-07).

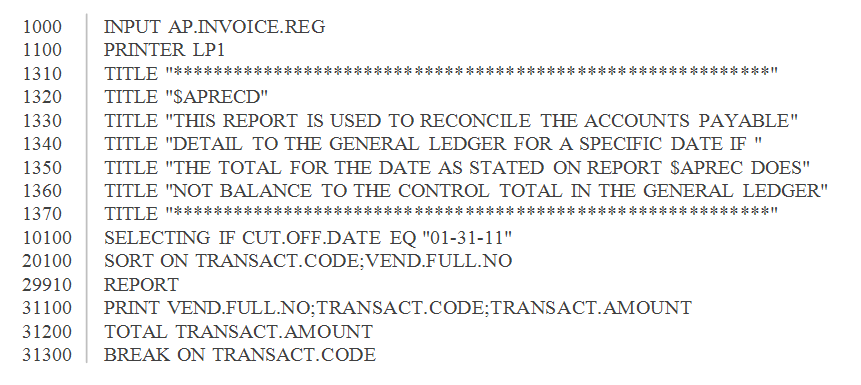

- Once you find a day that does not match, run the ‘$APRECD’ RDB report. This report shows transactions posted to the Accounts Payable detail for the selected date by Transaction Type and Vendor.

- Change the date on the ‘SELECTING’ line to the date for which the cut-off dates and amounts on the ‘$APREC’ report did not match the dates and batch totals in the A/P Control Account.

- Again, verify that your ‘$APRECD’ report matches the original shown here:

- Compare the ‘$APRECD’ report to the detail entries for the A/P Control Account in G/L Inquiry (15-07). Be aware that the entries on the ‘$APRECD’ report include transactions processed both in A/P and P/O-A/P Entry. On the G/L side (15-07), A/P and P/O-A/P Entry will post separately under their own unique transaction codes.

- Once you identify the transaction(s) that are causing the problem, you might be able to correct the issue on your own. If you cannot, contact Tyler support for advice on how to handle the situation. When contacting support, please be prepared to provide the above mentioned material and the steps already taken to resolve the issue.