NewsFlash #136

As the end of 2019 draws near, all of us here at Tyler would like to wish you a happy holiday season and best wishes for a prosperous New Year.

Like we do each December, we’ve put together our 2019 Year End Processing Instructions and FAQs to help you close out the year in Tyler. As always, please contact us with any questions or comments.

Please note that the information in this article subject to periodic revision as new information arises.

Table of Contents

- What’s New for 2019

- FAQs: W2, T4

- FAQs: 1099

- FAQs: Payroll

- Form Availability Summary

- Yearly Processing Overview

What’s New for 2019?

As a reminder to the letter you received in 2017, the Tyler Payroll application is no longer being updated to support changes to State or Provincial requirements. It will remain part of the base package if customers determine they can still use it in its present form. Please call Tyler Support if you have any questions.

United States

W2, 1099

The formats are unchanged from last year. This applies to all paper and electronic filing of W2s and 1099s.

No new programs are required to generate W2s and 1099s.

However, as stated in Newsflash #133, be aware of a possible alignment problem if printing these forms to a dot matrix printer that is connected to a Windows 10 PC. We recommend printing these forms to a laser printer to avoid the risk.

The deadline for both paper and electronic filing is January 31st, 2020. Penalties for improper filing have increased.

Also,new natural disaster tax breaks may be available to those affected. For more info, go to IRS.gov/DisasterTaxRelief.

Forms 1094-x, 1095-x

Tyler does not produce these forms. Please contact your health insurer or CPA for assistance.

Canada

T4 Form

No new program is required. The form is the same as last year. Should you have alignment or compliance issues, please contact us at support@tylernet.com with the details and your T4 form number. The form number is located on the bottom left corner of the T4 form. Our testing is verified to work on Form T4(14).

We are presently unaware of any changes to electronic T4s.

FAQs: W2s and T4s

- What are my options for printing Federal W2 forms?

- Federal W2 forms can be printed on laser or continuous feed printers. Electronic transfers may also be processed in Tyler if your company meets federal requirements. Please check irs.gov to determine eligibility.

NOTE: You cannot print W2s to a PDF file.

- What are my options for printing state W2 forms?

- State W2 forms can be printed on laser or continuous feed printers. Tyler does not offer electronic W2 reporting or uploads for any state unless your state accepts the federal electronic file format.

- When printing W2s / T4s on laser, do I need pre-printed forms or just blank paper? (Do laser forms print the boxes, labeling, etc)?

- You must acquire pre-printed forms. The program only prints the employee information and dollar amounts.

- What are my options for printing T4 forms?

- T4 forms can only be printed on laser printers or submitted electronically. They must be submitted via electronic spreadsheet if you have 50 or more employees.

- What are the correct printer settings in Convergence?

- Please use the following:

For Laser W2 Forms:

Emulation: System

Right Margin: 132

Lines per inch: Default

Characters per inch: 17For Laser T4 Forms:

Emulation: System

Right Margin: 132

Lines per Inch: Default

Characters per Inch: 17For Laser 1099 Forms:

Emulation: System

Right Margin: 0

Lines per Inch: Default

Characters per Inch: DefaultFor Dot Matrix W2 Forms:

Emulation: Generic

Right margin: 132

Lines per inch: Default

Characters per Inch: 17For Dot Matrix 1099 Forms:

Emulation: Generic

Right margin: 80

Lines per inch: Default

Characters per inch: 10

- Can I print W2 or T4 forms more than once?

- Yes, as many times as needed prior to running YTD reset.

- What happens if I have an employee who has worked in two US states?

- If an employee works in multiple states throughout the year, one W2 will support up to two states.

If an employee works in three or more states, a second employee number must be set up for that person. The third and fourth states’ figures will have to go under that second employee number.

- I’m a US client that has my own server. Will I need new programs for either W2 or 1099 processing?

- No, not if you used the programs last year.

- I’m a Canadian client that has my own server. Will I need a new program for T4 processing?

- No, not if you used the programs last year.

- Does my company’s federal and State/Province ID numbers print on W2/T4 forms?

- Yes. The Federal ID comes from 10-33, and the State ID comes from 10-30.

- Why can’t I get into 10-60?

- Most likely this is a TMIS Security issue and you will need to change your settings in 34-40. To correct, please add 10.60 with a code of ‘1’ in the applicable TMIS access code.

- How do I submit electronic W2s?

- In 10-60-20 enter your ‘Contact Email Address’ if this field is blank. Then complete 10-60-20 to build the file and 10-60-21 to download it. The file being downloaded is named ‘W2REPORT’. You will then send or upload the file to the IRS.

NOTE: This file is in a streaming format that is not conducive to spreadsheets.

- How do I submit electronic T4s?

- First run selection 10-60-10 to create the T4 file. Then run 34-80-03 to download the file (named ‘T4XML’) to your computer. Use #1 – ‘DOS text download’ and an output file name of ‘T4XML.xml’. You will then send or upload the file to Revenue Canada.

- Does Tyler sell blank W2 or T4 forms?

- No. Please visit your local office supply store for the forms that you require. Please visit irs.gov or the revenue Canada website. Tyler uses ‘1 across’ forms.

- Should I be using 2, 4 or 6 part forms?

- Ask your CPA or auditor. This varies by state or local requirements.

- What about employees who were terminated during the year?

- The applicable W2 for the portion of the year that the employee(s) worked will print. If it does not, it means that the 10-45 termination list was run mid-year, in error. Should this occur, please contact Tyler Support.

- How do I get the Misc. Box 12’s to print on my W2s?

- These amounts and codes must be manually entered for each employee. This is done in 10-60-01 (applies to Roth IRA’s, Employer-paid health insurance, etc.)

- The printing on laser W2s is very small. Can I make it bigger?

- You cannot. The font scaler is not adjustable.

FAQs: 1099

- Can I generate 1099 forms on Tyler??

- Yes. Before generating, make sure that the subcontractor info in the vendor master file is correct.

- What options do I have for obtaining 1099’s?

- 1099’s can be printed on continuous feed or laser printers, or transferred electronically.

- Does Tyler sell blank 1099 forms?

- No. Please visit your local office supply store for the forms that you require.

- In what order should 1099 forms be generated?

- See the following table:

FAQs: Payroll

- Can I process a 2020 payroll before running W2s?

- Before processing a pay run in January, the Year-to-Date Reset selection (10-15) must be run. YTD Reset should only be run after ALL required W2s have been printed and confirmed for accuracy. If your company wants to process a payroll prior to issuing W2s, Tyler suggests printing at least two copies of all needed W2s to a secure spooler for issuing at a later date. Also, if required to submit electronically, you will need to build and download your file in selection 10-60-20 and 10-60-21. If this option is chosen, Tyler highly recommends printing a YTD listing in 10-42.

- I completed my year to date reset in payroll; however when I printed my preview check register, I noticed that the prior year figures did not clear out. What’s wrong?

- Check selection 10-24; if the figures have reset for the year there, but are still appearing on the check stubs, your company probably ran the YTD reset after Payroll Calculation (10-10) was run. Try re-calculating the payroll in 10-10. If that does not resolve the problem, contact Tyler Support for assistance.

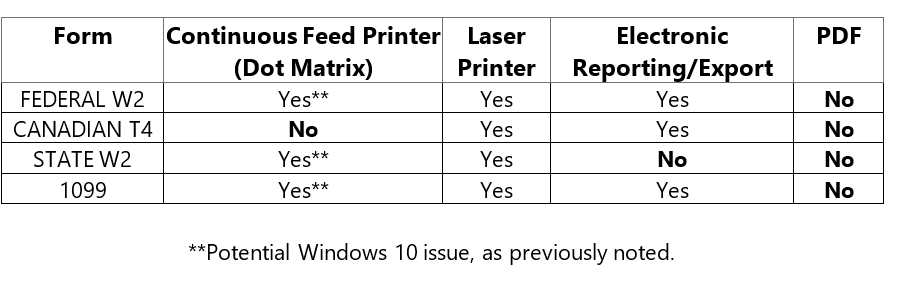

Form Availability Summary

Yearly Processing Overview

Complete the following to correctly close the year in Tyler.

Backup

(Stand Alone Servers only)

Please make two backups: one backup before Month End and Year End are started, and one after both are finished. Remove these 2 tapes from the normal rotation of backup tapes. If you back up to the cloud, make sure these are saved as well.

Accounts Receivable

12-81 Year End Processing

This selection zeros YTD figures in 12-20, Page 2.

If Revolving A/R is used, this selection also zeros the YTD finance charges in 14-37.

Payroll

10-60-11 Yearly Register

10-60-10 W2 Statements

10-60-20 Prepare File (If required to electronically transmit)

10-60-21 Download File to PC (If required to electronically transmit)

10-15 MTD, QTD, YTD Reset

10-45 Termination List

10-21 Employee Special Maint (optional)

For each employee, reset the “HOURS EARNED” for vacation and sick time to 40, 80, etc if these are replenished on January 1st and you wish to track them using Tyler. Vacation and Sick Time are deducted automatically by Special Check Entry, 10-03. Personal Time has no programming attached to it and must be manually maintained, if used.

Time Clock

10-62-90-03 Time Clock System Holiday Setup

Enter the 2020 paid holidays for your company (for which active, full time employees are to receive compensation.)

Accounts Payable Menu

11-42-06 Current 1099 Balance Report

11-42-05 Current 1099 Balance Maintenance

11-43 Year to Date Reset

11-42-01 1099 Maintenance

11-42-03 1099 Report

11-42-02 Form 1099 Print

11-42-07 Magnetic Media

11-42-04 Purge by Year

Fixed Assets

16-09 Year End Update

This selection zeros the year to date book and tax depreciation amounts for each asset. Make sure that last month’s depreciation calculation and update has been run before running the year to date Update.

Rental

22-81 Yearly Asset Processing

This selection zeros YTD depreciation in 22-40.

Centralized Delivery

21-90-60 Holiday Maint

Set up the holidays for 2020 that are ineligible for deliveries. Delete all expired holidays from 2018 and prior years, if they exist.

Spoolers

Evaluate the contents of all spoolers for cleanup. Erase unwanted jobs, then use selection 34-01-01 or 34-01-12 to download jobs you wish to save to your computer.

Discretionary Purge

37-20 Item Number Purge

It is recommended that obsolete or unwanted item numbers be evaluated for possible purging. Companies that have used the Tyler Inventory Import program (24-10) may especially benefit by evaluating and purging unwanted item numbers. Contact Tyler Support if you do not know your discretionary purge password or need other assistance.

General Ledger

15-05 Journal Entry

After the General Ledger has been closed for the last month of the fiscal year and the General Ledger’s Control Record (15-01) is in the first month of the new year, you must make a manual journal entry to move the dollars from the Current Profit/Loss Account on the Balance Sheet to the Retained Earnings Account on the Balance Sheet. Both of these accounts are in the Equity Section. This journal entry is made as a prior period entry dated the last month of the fiscal year. The result should be zero in the Current Profit/Loss Account.